Invoicing

Overview

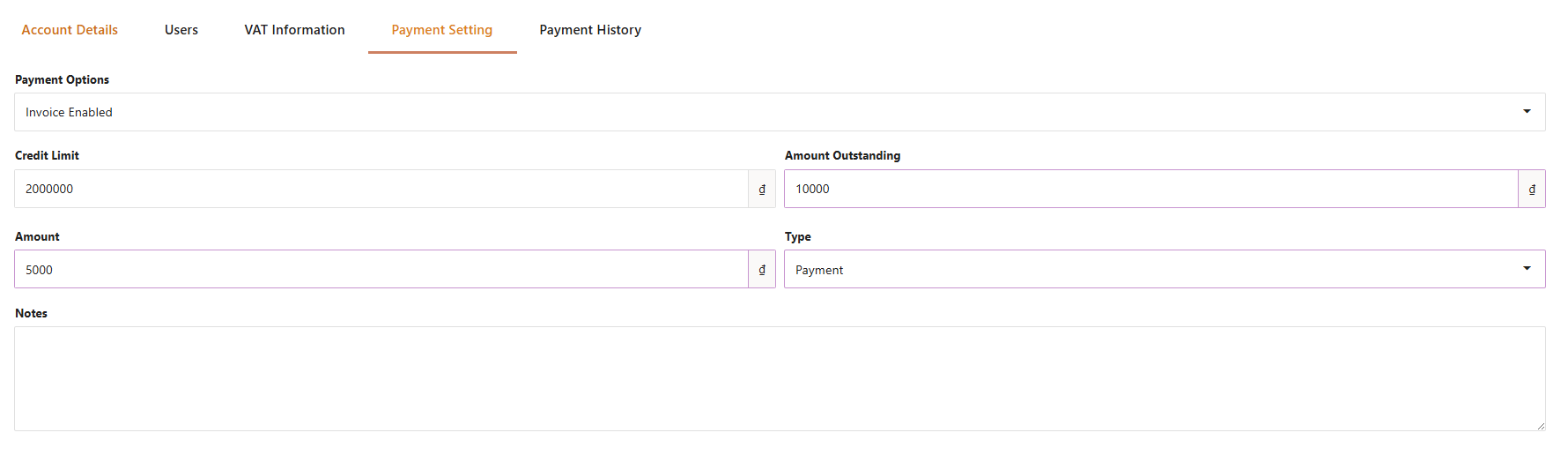

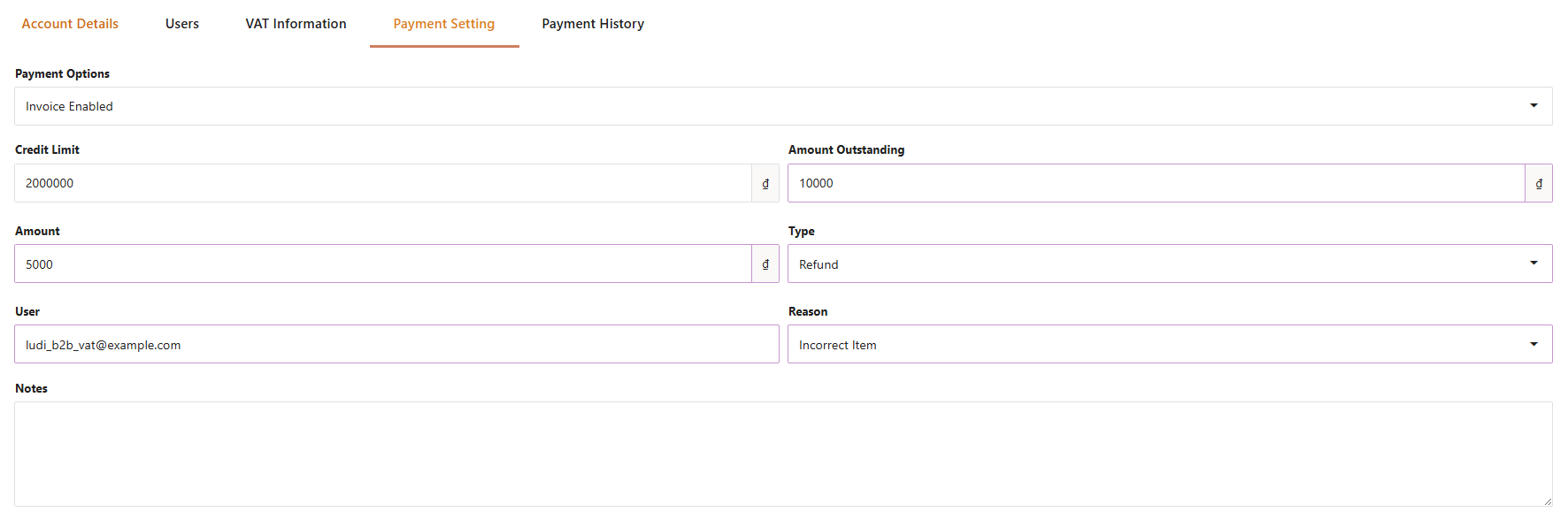

This option enables the business account to make purchases and defer payment to a later date. A credit limit can be set for the business account on Foxtrot and will shared among all users of the account. To enable invoicing, go Foxtrot Business Account > Payment Settings.

Definitions

For businesses set to Invoicing, Credit Limit and Amount Oustanding are defined as:

Credit Limit: Total credit limit for the entire business account (shared among all users of the business account)Amount Outstanding: Outstanding balance to be paid off by the business account

User Experience

All payment aspects (invoicing the customer, collecting & tracking payment) must be handled outside of the system.

When using invoicing, users of the business account can use a credit line to place orders.

They must use either use invoicing for all orders (payment set to Invoice Enabled) or they can choose to use invoicing or any other payment method to place orders (payment set to Invoice Enabled + Default).

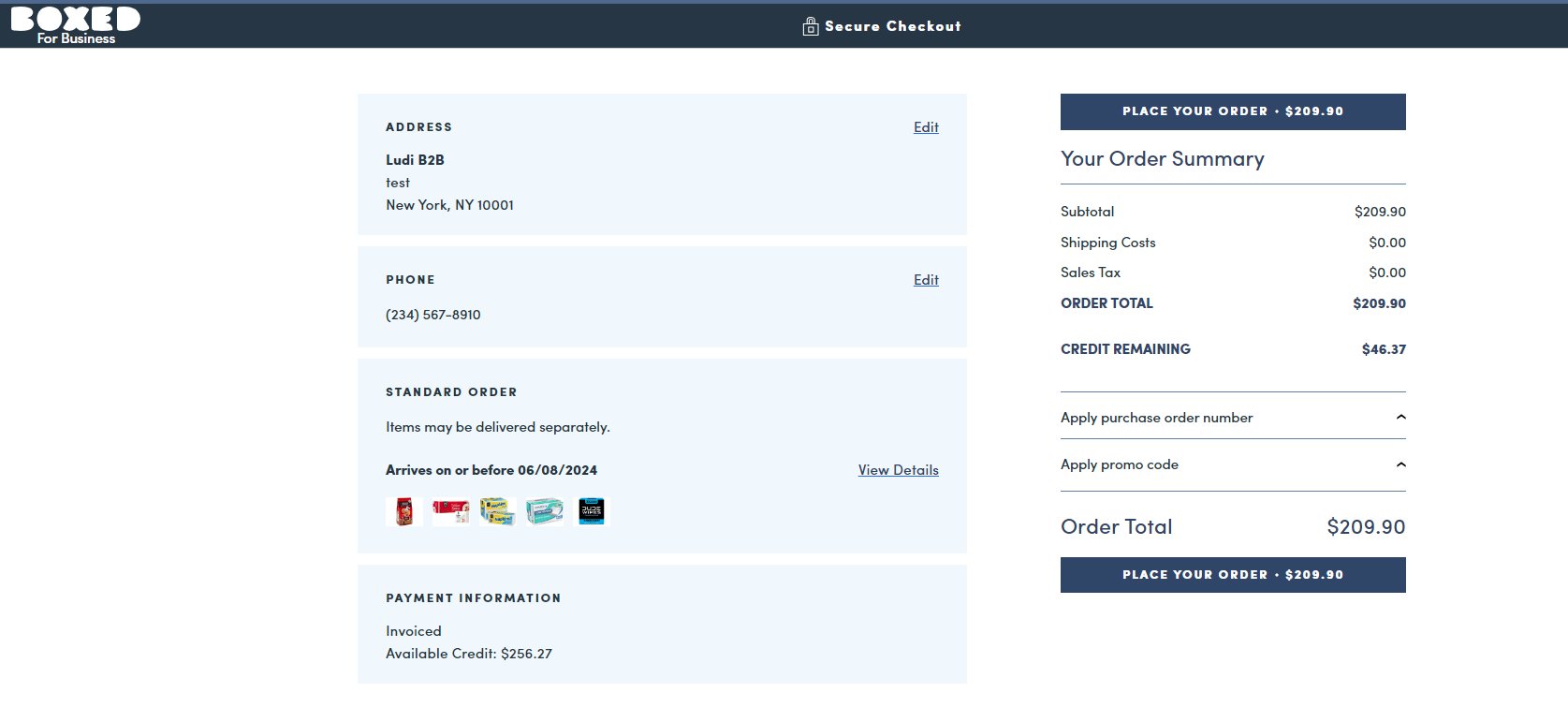

Checkout screen when using invoicng

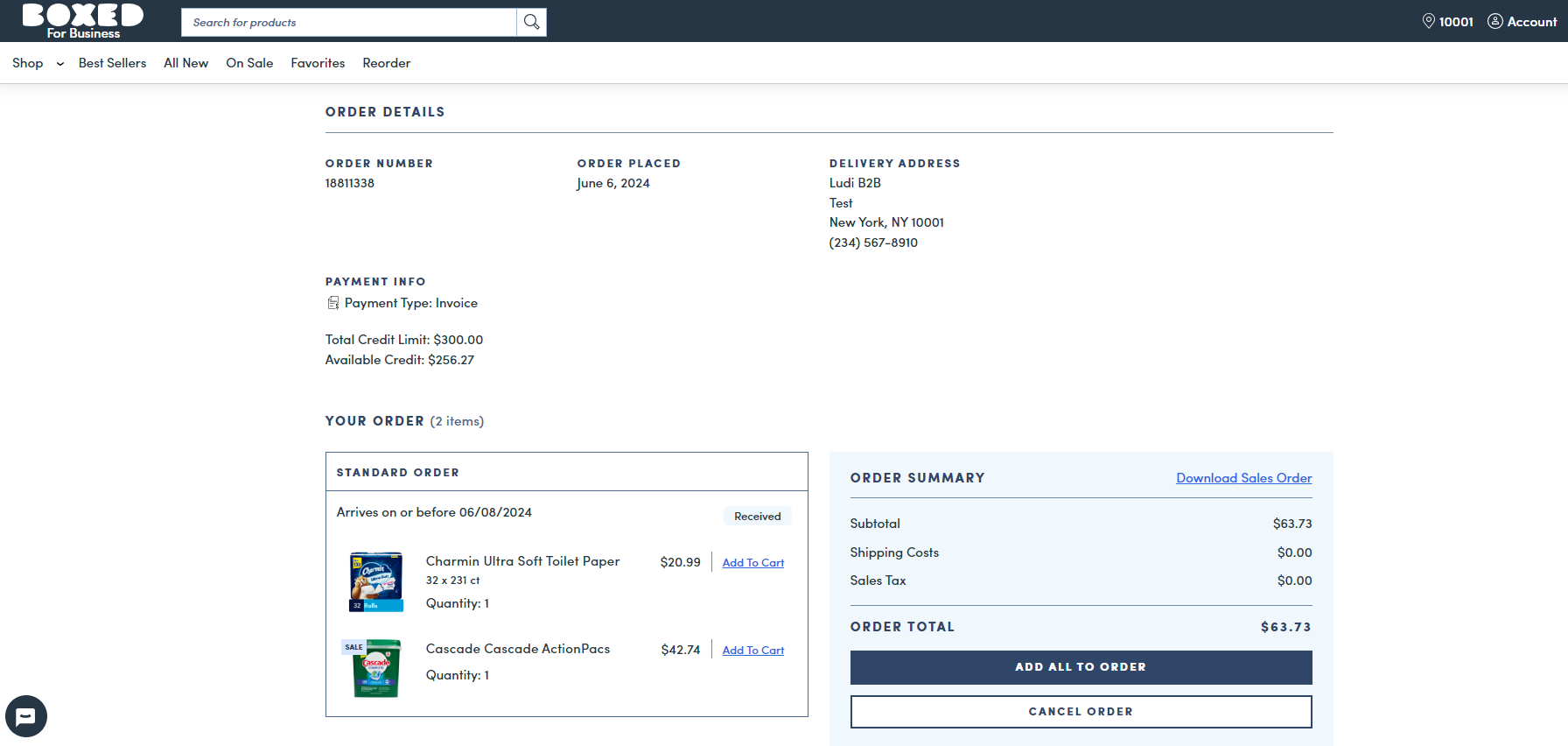

Order details screen for orders paid with invoicing

Credit remaining will be indicated at checkout. When the cart total is above the remaining credit, the user won't be able to place the order.

Recording Payments

As the business account issues payments to paid up their balance, you can reflect the payment in the system.

- Go to the Business Account's Payment Settings tab

- Fill out the amount of the payment in

Amount - Select type

Payment, which this records a payment against the balance - Click on

Update Business Account - The payment is applied to the oustanding balance of the business account and

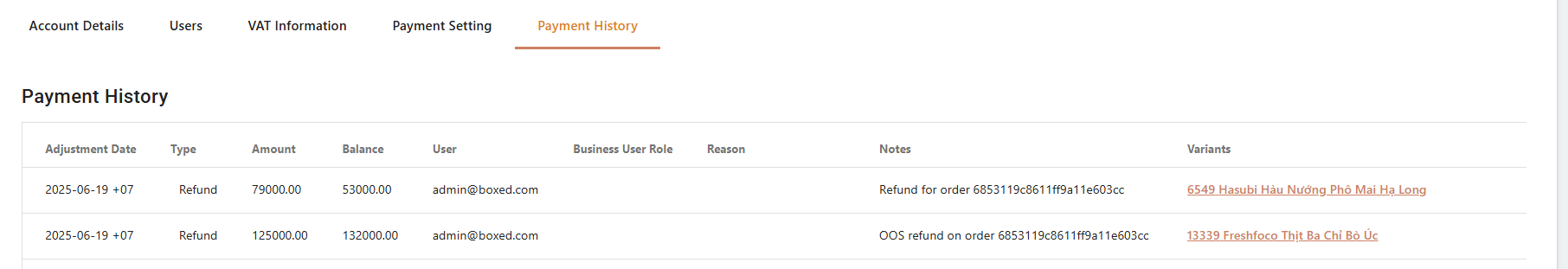

Amount Outstandingis updated to reflect the new balance. Payment will also be shown in the Payment History tab.

Applying Refunds

You can issue refunds for orders paid with invoicing in two ways, by creating a refund on the order or directly on the Business Account page.

Order Refunds

When issuing a refund from the orders page, the refund will be applied to the business account's outstanding balance. The refund will also be shown in the Payment History tab of the business account.

Example:

- Amount outstanding = $1000

- Order-level refund is issued for $20

- Amount outstanding becomes $980

Out of Stock Refunds

Refunds issued for out of stock items during order fulfillment are applied to the business account's outstanding balance.

The refund will also be shown in the Payment History tab of the business account.

Example:

- Amount outstanding = $1000

- Order is fulfilled and $30 worth of items are out of stock

- Amount outstanding becomes $970 after order completion

Custom Refunds

You can also issue a custom refund directly on the Business Account page, without tying it to an order.

- Go to the Business Account's Payment Settings tab

- Fill out the amount of the payment in

Amount - Select

Typeas Refund or CreditRefund: refund for damaged items, lost shipments, etc. The refund will be applied to the oustanding balance of the business account andAmount Outstandingwill be updated to reflect the new balance.Credit: apply a custom credit to reduce the account's balance. Credits and Refunds are both similar and used to reduce the balance owed by the customer.

- Fill out

Useras the user of the business account associated with the Refund or Credit - Fill out

Reasonas the reason for the Refund or Credit - Add

Notesif desired - Click on

Update Business Account - The refund/credit is be applied to the oustanding balance of the business account and

Amount Outstandingis updated to reflect the new balance. Refund/credit will also be shown in the Payment History tab.

Cancelled Orders

Refunds issed for cancelled orders paid with invoicing are applied to the business account's outstanding balance.

The cancellation refund will also be shown in the Payment History tab of the business account.

Updated 8 months ago